Elevate Your Lifestyle at...

JOIN US LIVE IN SUNNY...

ORLANDO, FL

Elevate Your Lifestyle at...

JOIN US LIVE IN SUNNY...

ORLANDO, FL

Imagine elevating your financial wellness while enjoying the sun-soaked allure of Florida.

At the Snowbird Investor Fall Masterclass, you'll unlock the keys to enhancing your quality of life through strategic property investing in Florida's vibrant market.

Join us in Orlando for an

exclusive 3-day experience designed to help you:

Boost Your Income: Learn how to maximize your returns and build substantial equity.

Enhance Your Lifestyle: Discover how Florida properties can enrich your daily life and provide the perfect blend of work and leisure.

Secure Your Assets: Implement proven strategies to protect your investments and financial future.

Optimize Your Taxes: Leverage the tax advantages available in Florida to reduce your tax burden legally.

Create a Lasting Legacy: Build and preserve generational wealth with smart investment planning.

Seize this opportunity to elevate both your financial and personal cross-border lifestyle. Don’t miss out on this chance to reshape your future in paradise.

Ready to enhance your quality of life?

FREE BONUS

Launchpad Membership

Community Forum

FL Investing 101

REI 101

Archive Replays

Florida Property Funding Blueprint

Florida Market Research & Data Analysis

Exclusive Online Live Touch Points

Community Forum

Connect and engage with a vibrant community of like-minded investors and industry experts.

Participate in discussions, ask questions, gain insights, and collaborate with others who are also on their journey to successful real estate investing.

FL Investing 101

Learn the fundamentals and the essential principles of investing in Florida's real estate market.

REI 101

Gain essential knowledge and practical insights to kickstart your journey and succeed in the dynamic world of real estate investment.

Archive Replays

Catch up on past Town Halls, "Act As If" sessions, and podcast episodes: Stay updated with our archive of past sessions.

Watch Town Halls to learn about the latest market trends and strategies.

Join "Act As If" sessions for practical tips and mindset shifts. Listen to podcast episodes with experienced investors sharing their stories and advice.

Florida Property Funding Blueprint (FPFB)

Learn how to correctly fund and finance your property investing business even before you step foot in the U.S.

The course covers institutions that lend to Canadian Foreign nationals without a U.S. Tax ID Number, Tax-free sources of capital to fund your deals, and non-traditional financing techniques to be able to close on those deals.

Florida Market Research & Data Analysis (FLMRDA)

Stay informed with the latest market trends and data.

This comprehensive video course extensively covers 12 Florida markets and important information on finding the best deals in Florida and analyzing them to get the best out of your investments.

Exclusive Online Live Touch Points

Stay tuned for upcoming live sessions and group onboarding opportunities.

LM + The Accelerator Bundle

Community Forum

FL Investing 101

REI 101

Archive Replays

Florida Property Funding Blueprint

Florida Market Research & Data Analysis

Exclusive Online Live Touch Points

Comprehensive Video Course

30-Day Acquisition-Ready Program

Home Study Kit

Monthly Group Coaching

FREE BONUS!

Launchpad Membership

Free for 30 Days

Start with a 30-Day Free Trial and gain access to:

Community Forum

Connect and engage with a vibrant community of like-minded investors and industry experts.

Participate in discussions, ask questions, gain insights, and collaborate with others who are also on their journey to successful real estate investing.

Real Estate Investing 101 (REI 101)

Gain essential knowledge and practical insights to kickstart your journey and succeed in the dynamic world of real estate investment.

Florida Investing 101 (FL 101)

Learn the fundamentals and the essential principles of investing in Florida's real estate market.

Exclusive Content Replays

Catch up on past Town Halls, "Act As If" sessions, and podcast episodes: Stay updated with our archive of past sessions.

Watch Town Halls to learn about the latest market trends and strategies.

Join "Act As If" sessions for practical tips and mindset shifts. Listen to podcast episodes with experienced investors sharing their stories and advice.

Florida Property Funding Blueprint (FPFB)

Learn how to correctly fund and finance your property investing business even before you step foot in the U.S.

The course covers institutions that lend to Canadian Foreign nationals without a U.S. Tax ID Number, Tax-free sources of capital to fund your deals, and non-traditional financing techniques to be able to close on those deals.

Florida Market Research & Deal Analysis (FLMRDA)

Stay informed with the latest market trends and data.

This comprehensive video course extensively covers 12 Florida markets and important information on finding the best deals in Florida and analyzing them to get the best out of your investments.

Exclusive Online Live Touch Points

Stay tuned for upcoming live sessions and group onboarding opportunities.

FEATURED IN

TICKET PRICING

Regular Price:

Limited Quantity Early Bird Tickets:

Limited number of tickets available at

1 Free Guest Policy: Spouse or Legal Business Partner

VIP Wine and Cheese Reception

3-Day Training

2 Dinner Events

Optional: Discounted On-Site Hotel Accommodations

Optional: Free Breakfast for On-site Hotel Attendees

Optional: Early Bird Live Online Training

Only 9 more tickets available at

1 Ticket per person

VIP Wine and Cheese Reception

3-Day Training

2 Dinner Events

Optional: Discounted On-Site Hotel Accommodations

Optional: Free Breakfast for On-site Hotel Attendees

Optional: Early Bird Live Online Training

Only 0 more tickets available at

1 Ticket per person

VIP Wine and Cheese Reception

3-Day Training

2 Dinner Events

Optional: Discounted On-Site Hotel Accommodations

Optional: Free Breakfast for On-site Hotel Attendees

Optional: Early Bird Live Online Training

WHAT YOU WILL LEARN

US ENTITIES

Did you know that the CRA does not recognize a lot of U.S. entities regardless of their legal status in the U.S.? Most of the research you find online is for U.S. citizens investing in the U.S. Coach Roel can guarantee you that if you follow those structures (if you’re NOT a U.S. citizen or a green card holder), you’ll have a hard time with the CRA.

In this workshop section, Coach Roel will talk about all the appropriate and relevant U.S. entities and their complex mechanisms for non-US Residents and Canadian Nationals. This segment is designed to save you as much time and effort as possible, so you can replicate the system without worrying about the CRA.

CROSS BORDER TAX & ASSET PROTECTION STRUCTURES

Coach Roel will be sharing all the secrets of how he successfully structured his cross-border U.S assets and fulfilled his tax obligations. He has done all the work for you, interviewed a lot of tax professionals, and banged his head against the wall so that you can save time, money, and energy.

His main goal is to give you a structure that is above board and allows you to sleep better at night, knowing that your cross-border assets are protected and compliant. It is crucial to get this right the first time around in order to save yourself a lot of frustration down the road.

BUILD NON-RECOURSE U.S. BUSINESS CREDIT

Ask any U.S. banker how to get better rates as a non-US/Canadian National and see what they say. They’ll all start by telling you to get a Social Security Number and then slowly build up your business credit. Then, ask them how you can go about getting a Social Security Number as a foreign national and you’ll be met with a blank stare. But what if Coach Roel told you that there’s a better way – to build your personal and business U.S. credit profiles – even BEFORE you step onto U.S. soil?

With the strategies he shares in this workshop, you’ll learn how you can build multiple business credit profiles, acquire non-recourse business credit, as well as personal credit all at the same time. It’ll be the fastest way for you to start getting better rates comparable to a U.S. citizen.

YOUR GENERATIONAL U.S. EMPIRE LEGACY

Not many people focus on their legacy when working hard to create a significant cross-border empire. But it is prudent to structure your assets as tax-efficiently as possible from an Estate Planning point of view right from the get-go.

This segment is designed to look ahead so that you can pre-plan your U.S empire for the benefit of the next generation. Coach Roel will be sharing a few different models of how the wealthiest of the wealthy structure their assets, taking full advantage of existing U.S laws when they pass on.

U.S. VISA OPTIONS AND WHY

There are more than a dozen U.S. visa options for you to choose from. They all have their pros and cons. But if you are planning to stay stateside without worrying about the default time limit of your stay, there are a few that are better than the others.

Coach Roel takes the guesswork out of the equation with this segment, as he has spent a lot of his own money speaking with various immigration consultants, so that you don’t have to. He’ll discuss several of the most relevant U.S Visa options available to Canadian and other U.S. foreign nationals and which are the best options given your situation.

HOW TO LEGALLY PAY $0 INCOME TAXES EACH YEAR

As Canadians, the CRA requires you to disclose all your worldwide income. Therefore traditional tax havens are out of the question. But very few Canadians realize that if their cross-border assets are appropriately structured, the U.S is quite literally their best tax haven, especially the state of Florida.

In this segment, Coach Roel will give you all the secrets he has learned the hard way as a Canadian real estate investor and business owner in the U.S. He’ll go over the US-Canada bilateral tax treaty in-depth and teach you how you can leverage that to your advantage–LEGALLY!

HOW TO RETIRE RIDICULOUSLY EARLY

Most of the popular advice you have been taught about money and wealth creation is wrong. How does he know this? Because when he was practicing as a traditional Certified Financial Planner for over 8 years in Canada, he used to perpetuate these myths thinking that he was helping people “pay down their debts” and “save for retirement”.

In this segment, you will learn why you can’t save your way to wealth, why cash is NOT king, and why traditional retirement is a myth. The truth is, there are several ways to achieve “financial freedom” that your banker doesn’t want you to know about. And it largely depends on your understanding of how money really works… as well as thinking “outside the box”.

Coach Roel will share with you his secrets for achieving financial freedom. You will formulate your personal plan with his personal support and his alumni-student strategy coaches on-site, so that you too can retire ridiculously early and live your best life now, rather than “someday”.

AGENDA

Day 0 - Wednesday, November 27, 2024

VIP Wine and Cheese Reception, 6:00 pm to 8:00 pm

Arrivals before 3:00 pm

Registration

Act-As-If Method

Speed Networking

Day 1 - Thursday, November 28, 2024

Best Practices for Success, 9:00 am to 5:00 pm

Free Breakfast (for attendees staying on-site)

Preparing for Success: Context vs. Content

How to Retire Ridiculously Early

Finding the Money

Choosing a Market

LUNCH ON OWN

Canadian Tax & Asset Protection

The Cross-Border Circle of Wealth

Building a Power Team

Field Training Preview

Day 1 Dinner Event, 6:30 pm to 9:00 pm

Understanding Human Motivation, Ambition, and Achievement

The Secret Science of Manifestation

Defining Success: How To Know When You've "Arrived"

Day 2 - Friday, November 29, 2024

Cross-Border Tax and Asset Protection, 9:00 am to 5:00 pm

Free Breakfast (for attendees staying on-site)

Cross-Border Entity Structures

Strategies for minimizing taxes on cross-border investments

Understanding the pros and cons of different asset protection structures

LUNCH ON OWN

Success Stories: Alumni Guest Speakers

Building U.S. Non-Recourse Business Credit

Cross-Border Banking

Tax Residency & Immigration Considerations

Day 2 Dinner Event, 6:30 pm to 9:00 pm

Karaoke Pizza Night

One-on-One Strategy Sessions

Day 3 - Saturday, November 30, 2024

Managing and Scaling Your Business, 9:00 am to 5:00 pm

Free Breakfast (for attendees staying on-site)

Preparing And Submitting Offers

Effective management practices for cross-border investments

Adding Value & Forced Appreciation

Vacation Rental Setup & Best Practices

LUNCH ON OWN

Building a team of professionals to support your cross-border investments

Creating a roadmap for managing and scaling your cross-border business

Next Steps Action Plan

Day 3 Evening, 5:00 pm to 9:00 pm

Free Time

Day 4 - Sunday, December 1, 2024

Free Breakfast (for attendees staying on-site)

Departures All Day

Don't miss your one chance to join us at our live and in-person event in Orlando, Florida.

Ask Yourself These Questions:

Have I ever wished to create my cross-border dream lifestyle of having the best of both countries?

Do I want to incorporate living cross-border into my regular lifestyle?

Do I want to own cross-border properties that pay for my trips?

Do I want my cross-border properties to generate income when I am not there?

Do I want my cross-border investments to be as tax efficient as possible and grow over time?

If the answer to any of these questions is yes, then this is an event you don't want to miss!

Investing in U.S. real estate, especially in Florida, is a great way to build generational wealth and achieve your cross-border dream lifestyle. After these three days, we will equip you with all the know-how to achieve this dream.

WHAT THIS EVENT IS & WHAT IT IS NOT

WHAT IT IS

This event is a 3-day live event that will take place in Orlando, Florida.

This event is for serious investors who want to expand into the U.S market.

This event is very exclusive, with just 42 seats available.

This event is an advanced level course intended for active real-estate investors and business owners.

WHAT IT IS NOT

This event is not a pre-recorded or virtual online event.

This event is not a get-rich-quick scheme.

It is not an event for the casual observer.

It is not an introductory course on the U.S. real-estate market for one-off property owners.

WHY FLORIDA?

Dream Lifestyle

Florida is essentially an island connected to the US mainland, and the State represents that laid-back island nature in every way possible.

The place has a 21℃ average temperature year-round and, not one, but two oceans within a couple hours driving distance from anywhere in the state.

It is replete with sun, sand, and palm trees. Over two hundred thirty sunny days per year.

Golf, tennis, fishing, cycling, anything you can imagine in your dream vacation destination.

Makes Business Sense

The state also personifies the American Dream in economic terms.

Have I ever wished to create my cross-border dream lifestyle of having the best of both countries?

Do I want to incorporate living cross-border into my regular lifestyle?

Do I want to own cross-border properties that pay for my trips?

Do I want my cross-border properties to generate income when I am not there?

Do I want my cross-border investments to be as tax efficient as possible and grow over time?

WHY FLORIDA?

Dream Lifestyle

Florida is essentially an island connected to the US mainland, and the State represents that laid-back island nature in every way possible.

The place has a 21℃ average temperature year-round and, not one, but two oceans within a couple hours driving distance from anywhere in the state.

It is replete with sun, sand, and palm trees. Over two hundred thirty sunny days per year.

Golf, tennis, fishing, cycling, anything you can imagine in your dream vacation destination.

Makes Business Sense

The state also personifies the American Dream in economic terms.

Have I ever wished to create my cross-border dream lifestyle of having the best of both countries?

Do I want to incorporate living cross-border into my regular lifestyle?

Do I want to own cross-border properties that pay for my trips?

Do I want my cross-border properties to generate income when I am not there?

Do I want my cross-border investments to be as tax efficient as possible and grow over time?

DETAILS

ARRIVAL AND DEPARTURE

Plan to arrive Wednesday, November 27 before 3:00 pm.

Plan to depart on Sunday, December 1 anytime.

We highly recommend that students extend their stay in Florida after the training to apply what they will learn.

VENUE LOCATION

The Masterclass will be held at a secret hotel location in Orlando, Florida revealed only to ticket holders.

The host hotel is located near International Drive, or as locals call it, I-Drive, which is famous for world-class bars, restaurants, and attractions.

ACCOMMODATIONS

To maximize the experience, we highly recommend attendees book their accommodations at the host hotel.

The main training days are from 9:00 am to 9:00 pm with breaks in between and lots of networking opportunities.

We have a limited number of deeply discounted hotel sleeping rooms allocated to our event available on a first come, first serve basis.

An exclusive discount booking link will be shared with ticket holders.

Staying at the host hotel would be more cost-effective–allowing you to save money from having to rent a car for 4 days and paying for breakfast each day.

Parking at the hotel is $16 per day, which you can also save if you stay at the hotel and don't rent a car.

Hot breakfast is included each morning for hotel guests.

FOOD

Hot breakfast is included each morning for hotel guests.

Lunches are on your own. Attendees will be encouraged to order their lunches delivered.

Dinner will be provided during the two evening training sessions.

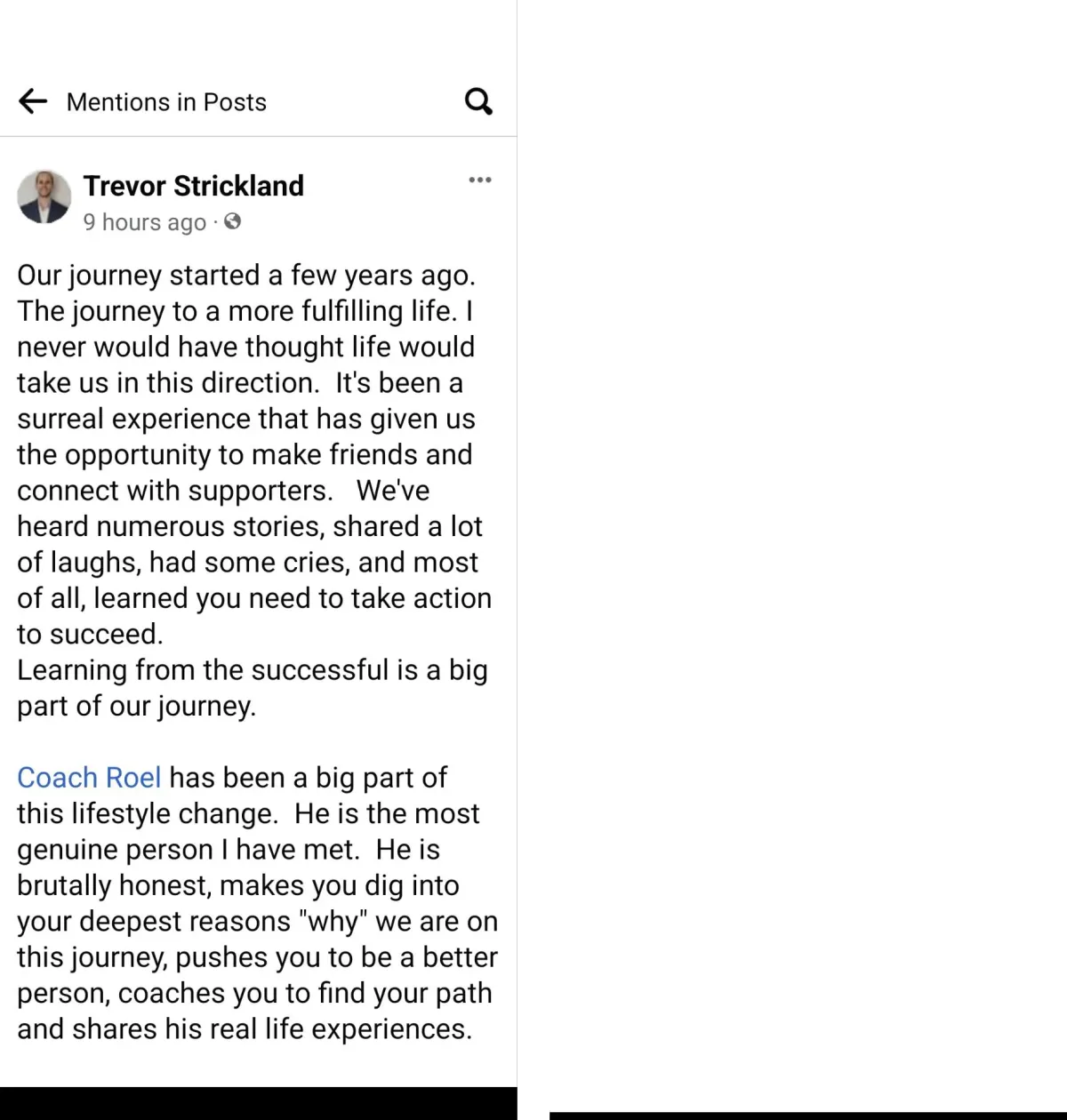

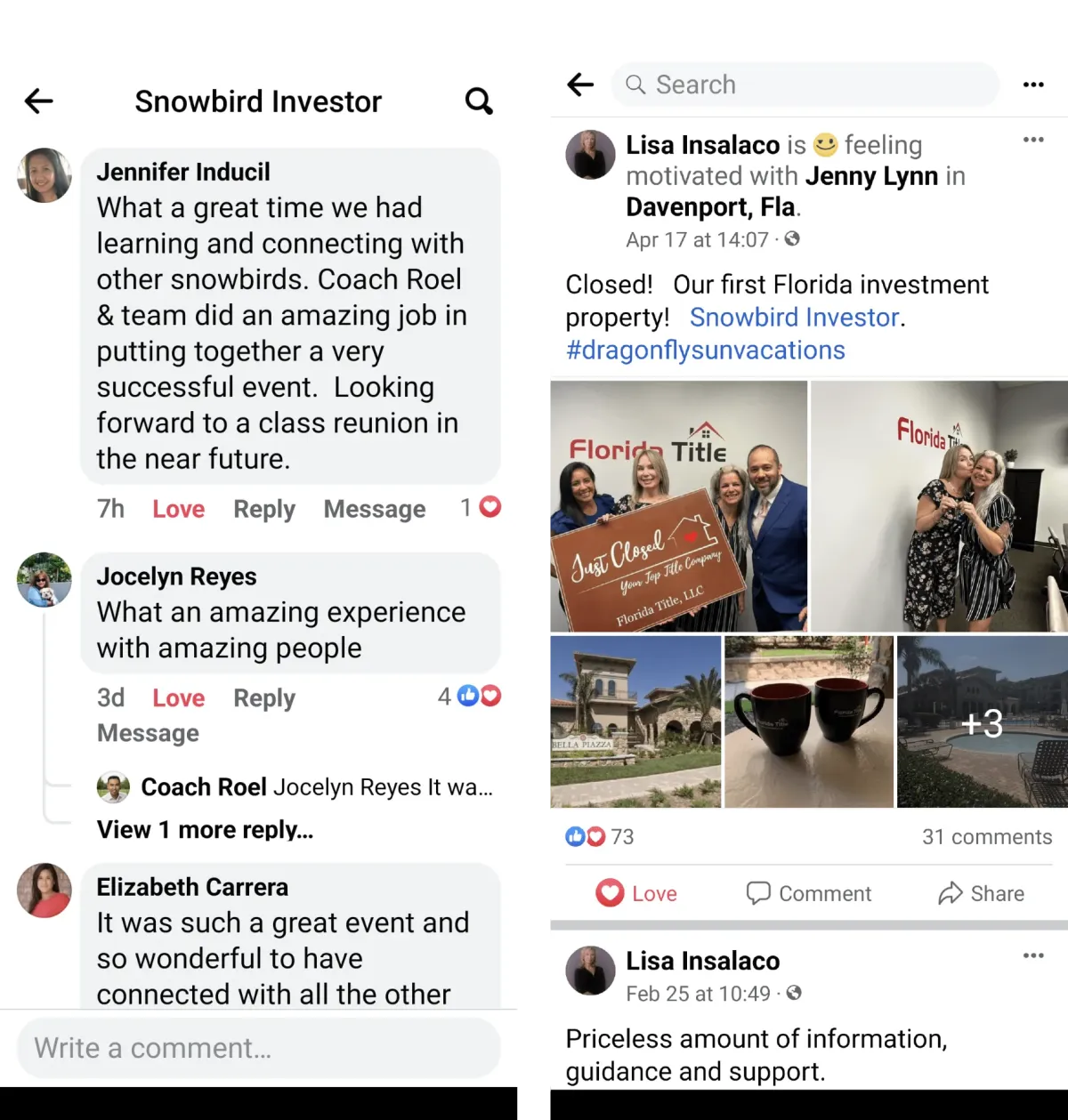

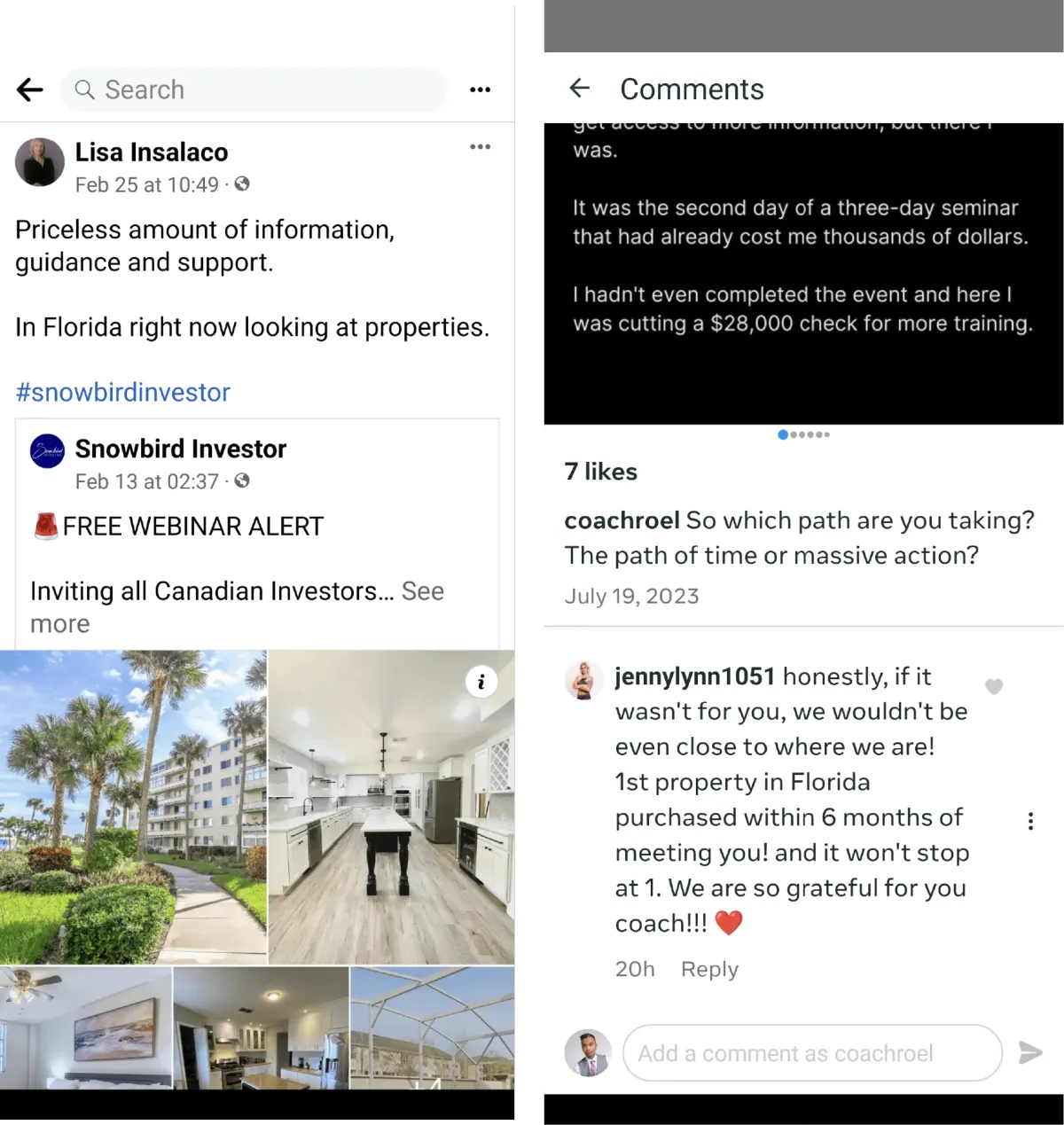

TESTIMONIALS

Elliot M.

Ottawa, ON

Steven & Editha N.

Burnaby, BC

Lisa I.

Cambridge, ON

Brian C. & Trevor S.

Lombardy, ON

Tom & AnnMarie K.

Brampton, ON

Irene A.

Milton, ON

Jocelyn T.

Brampton, ON

Steven & Editha N.

Burnaby, BC

Elliot M.

Ottawa, ON

Still Unsure or Have More Questions?

Reach out to us directly, and we’ll be happy to answer any more questions you might have regarding the event.

Contact us: